Request FedNow instant payment transactions

TodayPayments.com is a leading U.S.-based

platform for issuing ISO 20022 Request for Payments (RfP) across the

FedNow® and RTP® real-time payment networks.

We empower

businesses to digitize their invoicing with structured messaging,

alias-based identity, and instant fund confirmation — all without

traditional banking delays or dependencies.

Whether you’re billing once or forever, TodayPayments.com brings real-time certainty to every payment request.

Request FedNow® Payments with Rich ISO 20022 Messaging for B2B & C2B

![]()

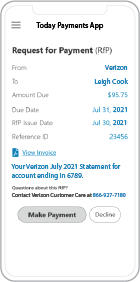

Request FedNow instant payment transactions and recurring Real-Time instant payments, are defined simply as: Irrevocably collected funds in a Payee bank account and usable immediately by the owner of the account. An upfront on-time 'standing approval' using Request FedNow instant payment transactions is an instruction or set of instructions a Payer uses to pre-authorize their financial institution to pay future

Request for Payments, RfPs without requiring the Payer to review and approve each RfP.

Request FedNow instant payment transactions and recurring Real-Time instant payments, are defined simply as: Irrevocably collected funds in a Payee bank account and usable immediately by the owner of the account. An upfront on-time 'standing approval' using Request FedNow instant payment transactions is an instruction or set of instructions a Payer uses to pre-authorize their financial institution to pay future

Request for Payments, RfPs without requiring the Payer to review and approve each RfP.

Real-time payments are evolving — and so is how businesses request them. Through the power of ISO 20022 Request for Payment (RfP) messaging, U.S. merchants can now send secure, structured requests for one-time, batch, or recurring transactions over both the FedNow® Service and RTP® Network.

TodayPayments.com provides a plug-and-play solution for digital RfP invoicing — allowing merchants to send smart payment requests using aliases like mobile numbers or email addresses, automate batch uploads, and instantly credit recipients through any credit union or financial institution.

Gone are the days of slow, manual invoicing. With TodayPayments.com, you can digitally request payments via FedNow® or RTP® using mobile, SMS, or email-based RfP links. Whether it’s a one-time charge, a recurring subscription, or a batch of invoices, we give you real-time speed and automation.

Features include:

- Create and send ISO 20022-compliant RfPs

- Bill customers through email, SMS, or mobile links

- Support B2B and C2B models using alias identifiers

- Use email or phone number as the Payee/Payer ID

- Ensure instant settlement with real-time credit certainty

Batch Upload ISO 20022 RfP Payment Files to All Credit Unions Nationwide

Merchants and finance teams can use TodayPayments.com to import payment requests in volume using .Excel, .XML, or JSON file formats. These files can be mapped to any alias or recipient bank and instantly routed for FedNow® or RTP® settlement.

Batch upload benefits:

- Upload requests to any credit union or bank in the U.S.

- Use standardized formats for scalability (.Excel, .XML, JSON)

- Include metadata, invoice IDs, and billing logic in each file

- Automate variable or fixed recurring requests

- Interoperate between FedNow® and RTP® networks

Whether you’re managing 5 or 500,000 invoices, we help you request payments efficiently and with total compliance.

Aliases + Open Messaging = Smarter, Faster Real-Time Billing

With alias-based billing and ISO 20022 RfP messaging, TodayPayments.com gives you the power of real-time payments — without requiring sensitive banking information from payers.

What makes this powerful:

- ✅ Use aliases (email or phone) instead of bank data

- ✅ Request one-time or recurring payments from customers

- ✅ Cross-network support: FedNow® and RTP®

- ✅ Support for mobile-first invoicing: text, email, link-based

- ✅ Real-time reconciliation and treasury confirmation

- ✅ No-code onboarding — just upload and go

- ✅ 24/7 merchant setup and support

- ✅ Works with QuickBooks® QBO

Facilitating FedNow instant payment transactions invoicing from payees to payers using digital ISO 20022 messaging involves several key steps and elements:

Payee Side (Invoicing):

- Invoice Generation: Payees create invoices detailing the payment amount, due date, invoice number, and any other relevant information using their accounting or invoicing system.

- ISO 20022 Messaging: Payees encode invoice data into ISO 20022 messaging format, ensuring standardized and interoperable communication.

- Digital Signature: Payees may apply digital signatures to invoices to ensure authenticity and integrity during transmission.

- Transmission: Payees transmit the ISO 20022-encoded invoices securely to the payer using digital channels such as email, electronic data interchange (EDI), or secure messaging platforms.

Payer Side (Receiving Invoices):

- Invoice Receipt: Payers receive the ISO 20022-encoded invoices digitally from the payees through secure channels.

- Decoding: Payers decode the ISO 20022 messages to extract invoice details and integrate them into their accounting or payment systems.

- Payment Authorization: Payers review the invoice details and authorize the payment through their banking app or online banking portal.

- ISO 20022 Payment Initiation: Payers encode payment instructions, including the payment amount, payee details, and payment date, into ISO 20022 messages.

- Digital Signature: Payers may apply digital signatures to payment instructions to ensure authenticity and integrity during transmission.

- Transmission: Payers transmit the ISO 20022-encoded payment instructions securely to their financial institution through digital channels.

Payment Processing:

- Real-Time Payment Execution: Upon receipt of the ISO 20022-encoded payment instructions, the payer's financial institution initiates the FedNow instant payment transaction in real-time.

- Funds Transfer: FedNow facilitates immediate funds transfer from the payer's account to the payee's account, ensuring timely payment processing.

- Payment Confirmation: Both the payer and payee receive instant confirmation of the payment transaction, providing assurance of payment completion.

Benefits:

- Efficiency: Digital ISO 20022 messaging streamlines invoicing and payment processes, reducing manual intervention and processing time.

- Accuracy: Standardized messaging formats ensure consistent data exchange, minimizing errors and discrepancies.

- Security: Digital signatures and secure transmission channels enhance data security, protecting sensitive payment information from unauthorized access or tampering.

- Speed: FedNow instant payment transactions enable immediate funds transfer, facilitating faster settlement and cash flow management for both payers and payees.

By leveraging digital ISO 20022 messaging for FedNow instant payment transactions invoicing, payees and payers can enjoy a streamlined and secure payment experience while ensuring compliance with industry standards.

Start Requesting Real-Time Payments with Confidence

Say goodbye to paper invoices and ACH delays.

With TodayPayments.com, you can request payments in real

time using ISO 20022 messaging — complete with file upload

automation, alias support, and FedNow® or RTP® delivery.

✅ One-time, batch, or recurring

✅ Email, SMS, mobile invoicing

✅

Alias support with real-time credit certainty

✅

Works with every U.S. credit union and bank

👉 Start sending smart payment requests today at TodayPayments.com — where real-time invoicing meets modern fintech.

Creation Recurring Request for Payment

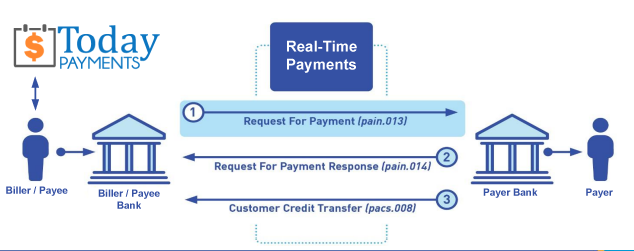

We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-TimePayments.com to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", either FedNow or RTP, will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

ACH and both Instant and Real-Time Payments Request for Payment

ISO 20022 XML Message Versions

The versions that

NACHA recommends for the Request for Payment message and the Response to the Request are pain.013 and pain.014

respectively. Version 5 for the RfP messages, which

The Clearing House Real-Time Payments system has implemented, may also be utilized as

there is no material difference in the schemas. Predictability, that the U.S. Federal Reserve, via the

FedNow ® Instant Payments, will also use Request for Payment. The ACH, RTP ® and FedNow ® versions are Credit Push Payments.

Payees ensure the finality of Instant Real-Time

Payments (IRTP) and FedNow using recurring Requests for

Payments (RfP), Payees can implement certain measures:

1.

Confirmation Mechanism:

Implement a confirmation mechanism to ensure that each

payment request is acknowledged and confirmed by the payer

before the payment is initiated. This can include requiring

the payer to provide explicit consent or authorization for

each recurring payment.

2.

Transaction Monitoring:

Continuously monitor the status of recurring payment

requests and transactions in real-time to detect any

anomalies or discrepancies. Promptly investigate and resolve

any issues that arise to ensure the integrity and finality

of payments.

3.

Authentication and

Authorization: Implement strong

authentication and authorization measures to verify the

identity of the payer and ensure that only authorized

payments are processed. This can include multi-factor

authentication, biometric verification, or secure

tokenization techniques.

4.

Payment Reconciliation:

Regularly reconcile payment transactions to ensure that all

authorized payments have been successfully processed and

finalized. This involves comparing transaction records with

payment requests to identify any discrepancies or

unauthorized transactions.

5.

Secure Communication Channels:

Utilize secure communication channels, such as encrypted

messaging protocols or secure APIs, to transmit payment

requests and transaction data between the payee and the

payer. This helps prevent unauthorized access or

interception of sensitive payment information.

6.

Compliance with Regulatory

Standards: Ensure compliance with

relevant regulatory standards and guidelines governing

instant payments and recurring payment transactions. This

includes adhering to data security requirements, fraud

prevention measures, and consumer protection regulations.

By implementing these measures, Payees can enhance

the finality and security of Instant Real-Time Payments

using recurring Requests for Payments, thereby minimizing

the risk of payment disputes, fraud, or unauthorized

transactions.

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Contact Us for Request For Payment payment processing